If 2025 taught us anything about commercial real estate, it’s that the market doesn’t follow a script.

National headlines warned of slowing deals and mounting debt pressures. Meanwhile, in Phoenix, cranes dotted the skyline around massive semiconductor plants, billion-dollar investments poured in, and brokers reported the kind of confidence we haven’t seen since before the pandemic.

As Arizona’s largest independent escrow company, we’ve closed transactions across every corner of this market. Here are some notable events from 2025, and what they might mean as we head into 2026.

National CRE Market Update

Let’s start with the reality check: In October 2025, commercial real estate deal volume declined year-over-year for the first time since early 2024. Transaction volume hit $24.4 billion for the month—still respectable, but down from October 2024.

The reason?

Buyers and sellers are stuck in what industry insiders are calling “the stalemate.” Sellers remember what their properties were worth two years ago. Buyers are looking at today’s interest rates and doing different math. Neither side wants to blink first.

But here’s where it gets interesting: Not every property type is facing challenges.

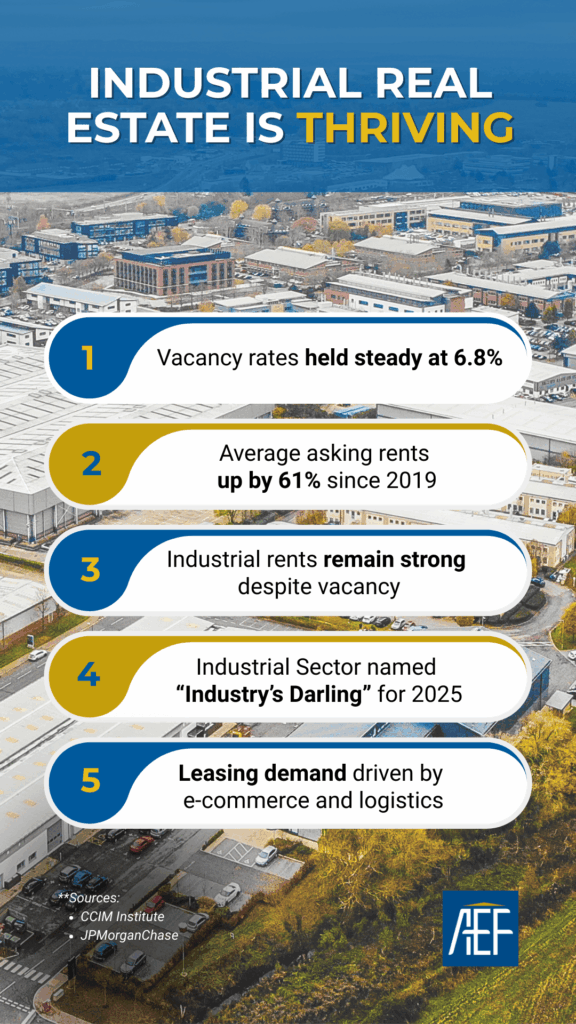

Industrial real estate is thriving.

- Vacancy rates held steady at 6.8%.

- Average asking rents hit $10.13 per square foot—up 61% from 2019.

- Warehouses, distribution centers, and logistics facilities continue attracting capital and commanding premium pricing.

Why does this matter? Because it shows that quality assets with strong fundamentals are still attracting buyers.

The $1.8 Trillion Problem Everyone’s Talking About

Nationally, here’s the number keeping commercial real estate owners up at night: $1.8 trillion in commercial loans will mature in 2026.

Many property owners locked in loans when rates were at historic lows. Refinancing those same loans today could mean 75% to 100% increases in debt service payments.

If you were paying $100,000 a month, you might be looking at $175,000 to $200,000 after refinancing.

What this means:

- For owners: Refinancing pressure is real. Some will need to sell, others will get creative.

- For buyers: Motivated sellers create opportunities, especially for well-capitalized buyers who can move quickly.

- For deal structures: We’ll likely see more seller financing, earnouts, contingent payments, and other creative solutions to bridge the gap between what sellers need and what buyers can pay at today’s debt costs.

Phoenix CRE Market Update: Growth and Opportunity

While national markets slowed down, Phoenix charged ahead with a story that’s equal parts manufacturing renaissance and real estate opportunity.

Confidence Is Back

Arizona State University’s new CRE Sentiment Index shows broker confidence at 62.7. That’s solidly above the 50-point optimism threshold.

During the pandemic, this index was in the 30s. In 2019, it was nearly 70.

We’re not all the way back, but the trajectory is clear: Phoenix’s commercial real estate community believes in where we’re headed.

The Numbers Back It Up

Through August 2025, Phoenix recorded $3.6 billion in commercial real estate sales across 201 transactions.

One highlight transaction:

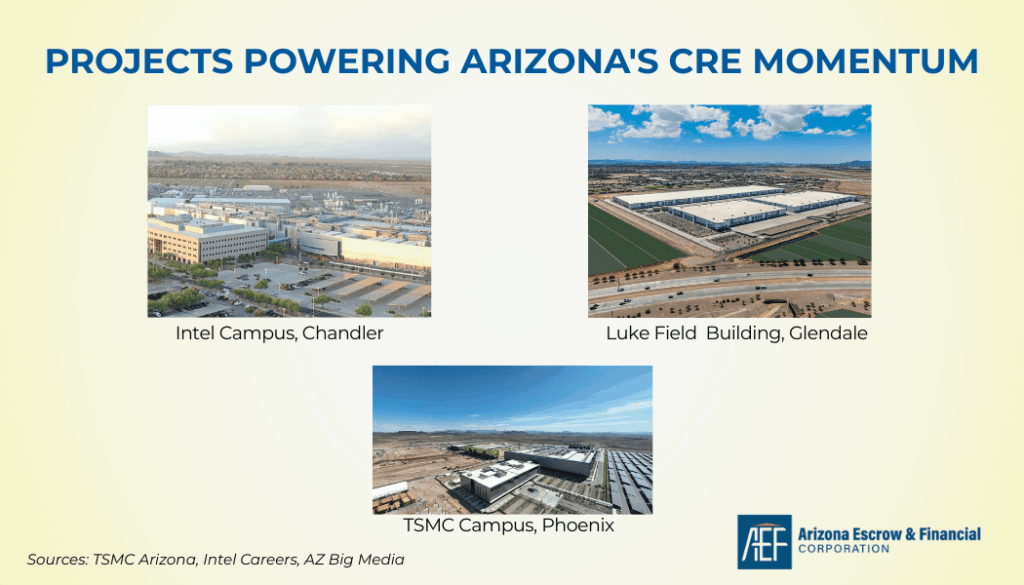

In December, Walmart paid a record $152 million for a 1.27 million-square-foot industrial building at Luke Field in Glendale. It’s the highest industrial sale in Arizona for 2025.

The deal demonstrates that Fortune 500 companies are betting big on Phoenix’s logistics infrastructure.

Semiconductors are Rewriting Phoenix’s Future

One of the biggest CRE developments in Arizona this year—semiconductors. This will likely define Arizona commercial real estate for the next decade.

TSMC’s investment in Phoenix has grown to $165 billion. What started as a $12 billion commitment in 2020 has exploded into the largest foreign direct investment in Arizona history.

In April 2025, TSMC broke ground on its third fabrication facility.

Then in October, something historic happened:

TSMC began mass-producing advanced Nvidia AI chips in Arizona. This is the first time in recent history that the world’s most advanced semiconductors are being manufactured at scale on American soil. Intel is pouring tens of billions into expanding its Chandler campus.

Combined, semiconductor manufacturers have invested over $210 billion in Arizona since 2020.

What This Means for Commercial Real Estate

The ripple effects are transforming the market:

- Supplier ecosystem creating real estate demand: Fourteen of TSMC’s key suppliers are establishing facilities in Arizona. These aren’t small operations. They are manufacturing plants, warehouses, and distribution facilities requiring substantial industrial space.

- Jobs driving housing and retail demand: TSMC alone will employ 6,000 workers directly, with thousands more in the supply chain. Those workers need places to live, eat, and shop.

- Industry validation: When SEMICON West moved to Phoenix in 2025, over 20,000 people showed up on opening day. That’s nearly double the attendance when the show was in San Francisco.

The industry has spoken: Phoenix is the place to be.

Arizona has become America’s semiconductor hub, and that’s creating commercial real estate opportunities that don’t exist anywhere else.

What Does All This Mean for 2026?

No one’s claiming 2026 will be easy, but it will be interesting.

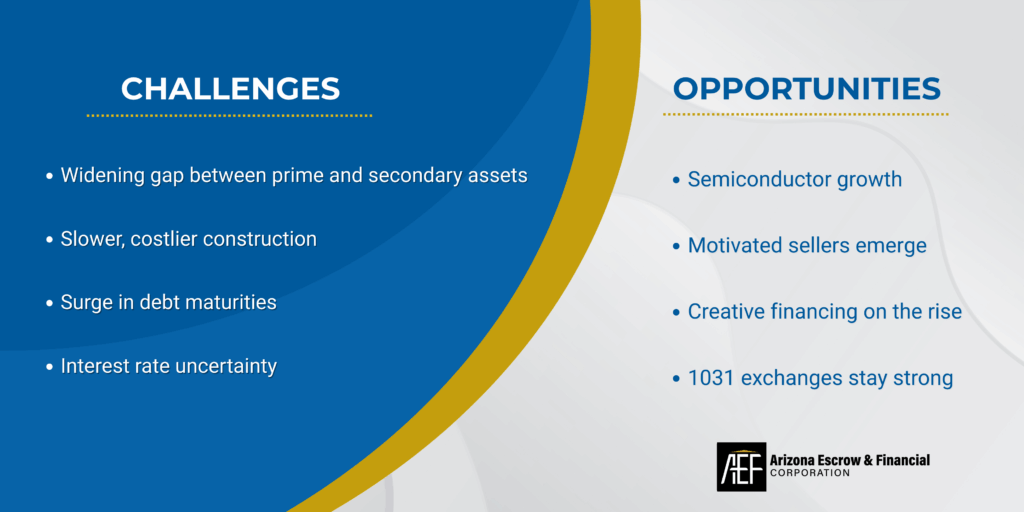

The Challenges:

- The debt maturity wave hits in earnest

- Interest rate uncertainty continues

- Construction will be harder and slower due to tariffs and labor shortages

- The gap between prime assets in strong markets and secondary properties will widen

The Opportunities:

- Strategic buyers will find motivated sellers

- Phoenix’s semiconductor ecosystem will continue growing

- More creative deal structures (seller financing, earnouts, contingent payments)

- 1031 exchanges remain protected—good news for investors repositioning capital

Specialized Partners for CRE Transactions

Here’s something we’ve learned after nearly 50 years: When transactions get complicated, the escrow process becomes more important, not less.

Think about what a typical 2026 transaction might look like:

- A refinancing component (because of the debt maturity cliff)

- Creative financing (seller notes, earnouts, contingent payments)

- Multiple parties (buyer, seller, lender, maybe SBA involvement)

- Tight timelines (motivated sellers move fast)

- High stakes (these aren’t small numbers)

That’s where specialized escrow expertise matters. At AEF, commercial and business transactions aren’t just part of what we do; they’re all we do.

We’ve spent nearly five decades becoming specialists in exactly these types of complex transactions.

As we head into 2026, complexity is becoming the new normal. Having the right partners—brokers who know the market, attorneys who understand creative structures, lenders who can move quickly, and escrow professionals who can manage intricate closing requirements—will make the difference between deals that close and deals that don’t.

Ready to navigate 2026’s opportunities? Let’s talk about your next transaction.

Disclaimer: Arizona Escrow & Financial Services makes no express or implied warranty regarding the accuracy, completeness, or reliability of the information provided and assumes no responsibility for errors or omissions. The information presented is for general informational purposes only and should not be considered legal, financial, or professional advice.

Arizona Escrow & Financial Services, the Arizona Escrow logo, and www.arizonaescrow.com are trademarks or registered trademarks of Arizona Escrow & Financial Services and/or its affiliates. Unauthorized use of these trademarks is strictly prohibited.

For more information, please visit www.arizonaescrow.com or contact us directly.

Monica May-Dunn

Monica May-Dunn is the Owner, CEO, and CFO of Arizona Escrow and Financial Corp., a leading provider of business escrow services since 1976. With over 30 years of industry expertise, she has expanded AEF’s portfolio, driven record growth, and launched a leadership podcast. Recognized as one of AZRE’s “Most Influential Women in Commercial Real Estate 2024,” she is a strategic leader, mentor, and active voice in industry innovation.

Disclaimer: Arizona Escrow & Financial Services makes no express or implied warranty regarding the accuracy, completeness, or reliability of the information provided and assumes no responsibility for errors or omissions. The information presented is for general informational purposes only and should not be considered legal, financial, or professional advice.

Arizona Escrow & Financial Services, the Arizona Escrow logo, and www.arizonaescrow.com are trademarks or registered trademarks of Arizona Escrow & Financial Services and/or its affiliates. Unauthorized use of these trademarks is strictly prohibited.

For more information, please visit www.arizonaescrow.com or contact us directly.