Are smart contracts making escrow services obsolete? Definitely not.

Escrow services exist because transactions need trust, neutrality, and efficiency–qualities that technology alone can’t guarantee. Smart contracts offer an interesting glimpse into the future but we think that they are very far from replacing traditional escrow services.

In fact, the concept behind smart contracts was proposed way back in 1994 by American computer scientist, Nick Szabo, but they are still rarely used in escrow services or commercial real estate transactions.

The technology shows potential, but its real-world adoption remains limited.

Still, it’s worth exploring what smart contracts could mean for the future of escrow.

Advanced technology is the driving force of evolution in many industries, from finance to real estate. It’s also revolutionizing escrow services, offering a new way to manage transactions with speed and efficiency.

At Arizona Escrow & Financial, we’re here to break down the hype, the reality, and why traditional escrow services will still be essential in our tech-driven future. With decades of expertise, we understand that while innovation can enhance our services, trusted, experienced professionals remain essential for managing complex transactions.

Smart Contracts Explained

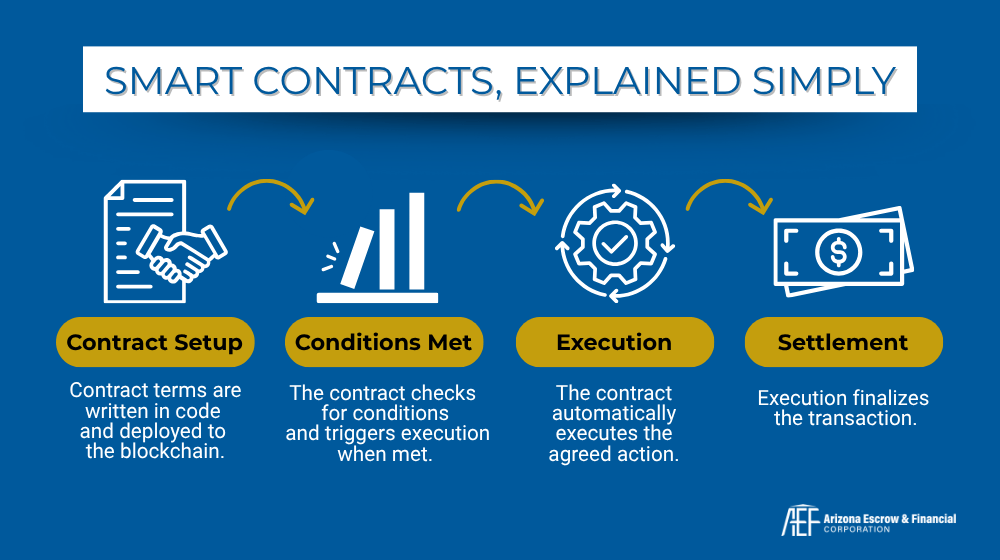

At their core, smart contracts are self-executing digital agreements that are stored on a blockchain. They automatically enforce the terms of the contract once they can verify that the predefined conditions have been met.

- Defining Contract Terms and Deployment: The first step involves all the parties agreeing on contract terms such as payment amounts, deadlines, milestones, etc. Using programming languages, these terms are coded into blockchains. Once these terms have been transcribed into code, the contract is stored on the blockchain, making it immutable. Next, the contract is deployed onto a blockchain network, making it active and visible to all participants.

- Triggering Conditions: After deployment, the smart contract continuously monitors for predefined conditions. If conditions are met, the smart contract moves into the execution phase.

- Automatic Execution: When the predefined conditions are met, the smart contract automatically executes the agreed-upon action. This could involve releasing funds, transferring ownership, or recording transaction details.

The Missing Link in Smart Contracts

Blockchain technology allows smart contracts to track digital activities of involved parties. However, blockchains can’t access data that is not recorded in them and they need oracles to access real world data.

Oracles are software applications that can provide financial data, property records or even shipping information to trigger contract execution.

Keep in mind that smart contracts are NOT legal agreements, they are simply code that performs a function. They don’t replace legally binding contracts but can complement them.

Consulting experienced escrow service providers or legal professionals can help you navigate blockchain technology.

Limited Adoption of Smart Contracts in Real Estate

Smart contracts operate on decentralized blockchain networks and they do offer some interesting possibilities for the future. They are particularly effective for simple, automated transactions with clear, predefined conditions.

For example, freelancers can use smart contracts to automatically release payment once a project milestone is approved. Their potential use in real estate transactions has been discussed with some excitement among blockchain and cryptocurrency enthusiasts.

Right now, small businesses seeking streamlined payments have successfully utilized smart contracts, but their application in larger, more complex industries is still uncommon. To date, there has only been one verifiable real estate transaction using smart contract technology—a property sale in Ukraine.

Even though they are not currently being utilized as escrow technology and are likely a long way off, we are always looking to the future and keeping an eye on emerging tech in our industry.

Below, we break down why–so far—we believe smart contacts are Hype.

Why Smart Contracts Can’t Fully Replace Traditional Escrow Services

Smart contracts are ideal for very simple, straightforward transactions. For anything requiring judgment or dispute resolution, traditional escrow is needed.

Here’s why:

- Dispute Resolution – Smart contracts work on fixed conditions. So if issues arise, they aren’t flexible enough to resolve them. Traditional escrow services are needed to execute fiduciary responsibilities, provide objective third-party oversight (ensuring fair outcomes), and handle edge cases and outliers.

- Regulatory Compliance – Smart contracts are not legally recognized in many jurisdictions. Traditional escrow service providers ensure compliance with regulations, industry standards, and laws.

- Custom Solutions – You can’t transcribe all the terms of unique and complex transactions into code. This is why you’ll need traditional escrow services for judgment-based decisions, complex negotiations, flexible terms, or additional verifications.

- Accountability and Oversight – Smart contracts are automated and lack human intervention. While this may seem efficient, it also means there’s no one to oversee the process if something goes wrong. Traditional escrow agents help ensure accuracy by identifying errors that automated systems might miss.

Instead of fully replacing traditional services, smart contracts may become complementary tools. Hybrid escrow models could combine the efficiency of blockchain automation with the oversight, judgment, and dispute resolution of human escrow agents.

The Road Ahead for Escrow Services

We believe the future of escrow services will be to continue to utilize emerging tech to help provide efficiency in processes. Smart contracts have the potential to reshape the business landscape. There are some exciting new innovations ahead that will enhance and complement their use, including:

- DLT and Smart Legal Contracts – Distributed Ledger Technology (DLT) is paving the way for smart legal contracts, which embed legal enforceability into blockchain-based contracts.

- AI Strengthening Cyber Security – As escrow services go more digital, artificial intelligence is being explored for fraud detection, risk assessment, and real-time monitoring.

- New Type of Escrow Insurance – With the growth of blockchain technology, we may see escrow insurance specifically designed for smart contracts–protecting against coding errors, hacks, bugs, or other breaches.

- Tokenization of Real Estate – Real estate is starting to take a page from the NFT playbook. Physical properties can be transformed into digital tokens on a blockchain. Escrow services could make it easier to manage fractional ownership, speed up transfers, and simplify multi-party deals.

With over 40 years of expertise, Arizona Escrow & Financial has helped clients of all sizes navigate complex transactions with confidence. As the industry evolves, our team remains committed to providing reliable escrow services that adapt to changing needs and ensure smooth closings. Contact us today!

Disclaimer: Arizona Escrow & Financial Services makes no express or implied warranty regarding the accuracy, completeness, or reliability of the information provided and assumes no responsibility for errors or omissions. The information presented is for general informational purposes only and should not be considered legal, financial, or professional advice.

Arizona Escrow & Financial Services, the Arizona Escrow logo, and www.arizonaescrow.com are trademarks or registered trademarks of Arizona Escrow & Financial Services and/or its affiliates. Unauthorized use of these trademarks is strictly prohibited.

For more information, please visit www.arizonaescrow.com or contact us directly.

Annette Anderson

Disclaimer: Arizona Escrow & Financial Services makes no express or implied warranty regarding the accuracy, completeness, or reliability of the information provided and assumes no responsibility for errors or omissions. The information presented is for general informational purposes only and should not be considered legal, financial, or professional advice.

Arizona Escrow & Financial Services, the Arizona Escrow logo, and www.arizonaescrow.com are trademarks or registered trademarks of Arizona Escrow & Financial Services and/or its affiliates. Unauthorized use of these trademarks is strictly prohibited.

For more information, please visit www.arizonaescrow.com or contact us directly.