Navigating the intricate process of escrow closings in a commercial real estate transaction demands more than just a signature; it requires a strategic approach. Our comprehensive 5-point checklist, derived from the insights of seasoned escrow agents, unveils the crucial elements for a seamless escrow closing.

These invaluable tips address common pitfalls, ensuring that you, as a buyer or seller, are well-prepared to tackle the complexities that may arise during this critical phase. As every escrow agent fervently wishes their clients knew, our checklist becomes your trusted guide to a successful escrow closing.

Closing on a commercial real estate transaction is a complex process to understand so escrow closing requires careful planning, attention to detail, and a good escrow team to work with. There are five ways to ensure your escrow process goes smoothly that every escrow agent wishes their customers knew.

1. Schedule Enough Time To Close

The escrow process timeline is critical. One of the most common mistakes made during the escrow process is not allocating enough time for the closing. It typically takes 30 – 60 days for escrow closing, however, closing on a property has several points of failure and involves multiple parties, including the buyer, seller, agents, lenders, and possibly attorneys.

The escrow process timeline is critical. One of the most common mistakes made during the escrow process is not allocating enough time for the closing. It typically takes 30 – 60 days for escrow closing, however, closing on a property has several points of failure and involves multiple parties, including the buyer, seller, agents, lenders, and possibly attorneys.

Delays can occur for various reasons for any of these parties, such as unexpected issues with the property, financing challenges, or paperwork discrepancies. It’s essential to schedule ample time for the closing process. Communicate with all parties involved to set realistic expectations and timelines, preventing last-minute rushes that can lead to complications.

2. Have Property & Legal Documentation Ready

Proper documentation is the backbone of any successful escrow closing. Failing to provide documents promptly can lead to lengthy delays or even the cancellation of the closing.

Before the scheduled closing date, ensure that you have all required paperwork, including identification, loan documents, inspection reports, and any other relevant information. Collaborate closely with your commercial real estate agent or attorney to create a checklist of essential documents and verify their completeness well in advance.

3. Understand Escrow Closing Costs

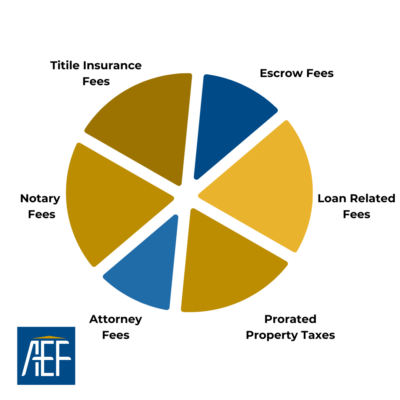

Closing costs can be a significant source of stress for everyone involved in the purchase of a property. It’s crucial to clearly understand the closing costs associated with your real estate transaction. These costs may include things like:

- Title Insurance Fees: For both the owner (title defects or claims post-purchase) and the lender (required to protect the interest in the property), title insurance will be required, and may be fees passed on to the buyer.

- Escrow Fees: Escrow companies or attorneys facilitate the closing process by holding funds and documents until all conditions are met. They charge a fee for their services.

- Loan-related Fees: Fees can be imposed by lenders for a variety of services, loan origination, appraisal and credit report fees are common.

- Recording Fees: Charged by the local government to record the new deed and other documents related to the property transfer.

- Prorated Property Taxes: Property taxes may be prorated between the buyer and seller, depending on the closing date.

- Attorney Fees: If an attorney is involved in the closing process, there may be fees for their services.

- Property Inspection Fees: Although typically paid before the closing, inspection fees contribute to the overall cost of the transaction.

- Courier and Wire Transfer Fees: Charges for sending important documents and transferring funds securely.

- Notary Fees: Costs associated with having documents notarized during the closing process. Fees may be included in services, be sure to ask your escrow agent.

- Miscellaneous Fees: Various other fees may arise depending on the specific circumstances of the transaction, such as survey fees or pest inspection fees

Work closely with your commercial real estate agent or escrow officer to review and understand the estimated closing costs early in the process. Being well-informed about these expenses helps you plan accordingly and avoid any last-minute financial surprises.

4. Communicate with Your Agent

Effective communication is key throughout the escrow process. Failure to stay in close contact with your agent can lead to misunderstandings, missed deadlines, and unnecessary complications.

Regularly check in with your agent, promptly respond to requests for information or documentation, and keep the lines of communication open.

5. Know & Use The Value Of An Escrow Agent

Who does the escrow agent work for? Both parties in a transaction.

Who does the escrow agent work for? Both parties in a transaction.

An escrow service is, by definition, an unbiased third party that has a fiduciary responsibility to each party in the transaction. This impartiality allows both parties to feel confident and at ease during the transaction. Beyond the four critical points mentioned above, there are ways a qualified escrow expert can help you in this process:

Professional Guidance: Seek advice from experienced real estate professionals, including your escrow agents, real estate agents, and relevant attorneys. Their expertise can provide valuable insights and help you navigate any complexities that may arise.

Double-Check Details: Review all documents and details meticulously with your escrow agent. Small oversights can lead to significant issues during escrow closings. Take the time to double-check everything and seek clarification on any points of confusion.

Stay Informed: Stay informed about the progress of the escrow process. Regularly communicate with your agent to ensure that all necessary tasks are being completed on time, and address any concerns promptly. This includes having an idea of deadlines, documentation, and any possible issues.

Download the checklist as your guide and gain the knowledge to navigate challenges and ensure a smooth closing.

Disclaimer: Arizona Escrow & Financial Services makes no express or implied warranty regarding the accuracy, completeness, or reliability of the information provided and assumes no responsibility for errors or omissions. The information presented is for general informational purposes only and should not be considered legal, financial, or professional advice.

Arizona Escrow & Financial Services, the Arizona Escrow logo, and www.arizonaescrow.com are trademarks or registered trademarks of Arizona Escrow & Financial Services and/or its affiliates. Unauthorized use of these trademarks is strictly prohibited.

For more information, please visit www.arizonaescrow.com or contact us directly.

Arizona Escrow Editor

Founded in 1976 by Donald E. Graham, Arizona Escrow & Financial Corporation is Arizona’s largest independent escrow provider, specializing in business sales, personal property, and commercial real estate transactions. Its customer base includes individuals, businesses, business and real estate brokers, law firms, commercial and SBA lenders, banks, major corporations, tribal communities, state and municipal government organizations and departments, internet entities, and other parties requiring an experienced and professional escrow company. Under the leadership of CEO Monica May-Dunn since 2023, AEF remains committed to personalized service, instilling confidence in clients, and setting the standard for excellence in the escrow industry. For more information, visit arizonaescrow.com/services.

Disclaimer: Arizona Escrow & Financial Services makes no express or implied warranty regarding the accuracy, completeness, or reliability of the information provided and assumes no responsibility for errors or omissions. The information presented is for general informational purposes only and should not be considered legal, financial, or professional advice.

Arizona Escrow & Financial Services, the Arizona Escrow logo, and www.arizonaescrow.com are trademarks or registered trademarks of Arizona Escrow & Financial Services and/or its affiliates. Unauthorized use of these trademarks is strictly prohibited.

For more information, please visit www.arizonaescrow.com or contact us directly.